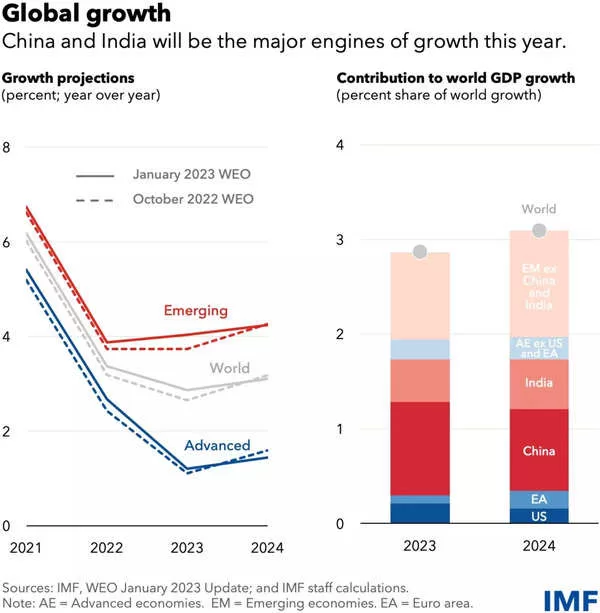

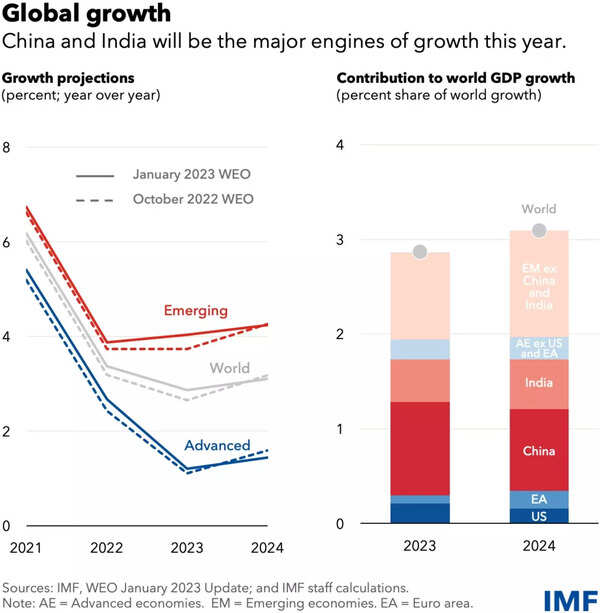

“India remains a bright spot. Together with China, it will account for half of global growth this year, versus just a tenth for the US and euro area combined. Global inflation is expected to decline this year but even by 2024, projected average annual headline and core inflation will still be above pre-pandemic levels in more than 80 percent of countries,”said Gourinchas.

The IMF said global inflation is expected to decline in 2023 but even by 2024, projected average annual headline and core inflation would still be above pre-pandemic levels in more than 80 per cent of countries.

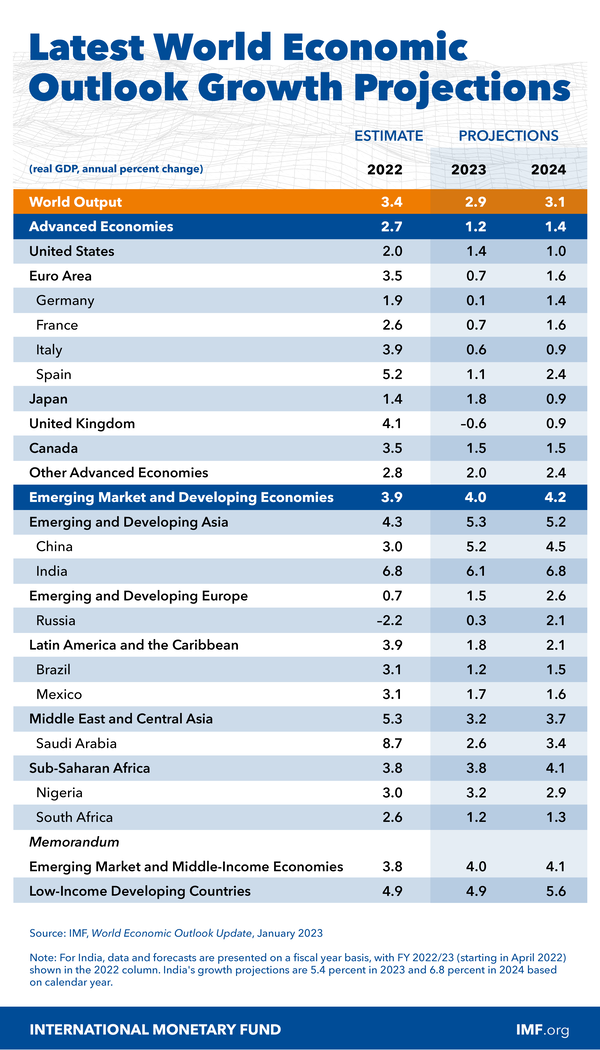

Growth in India is set to decline from 6.8 per cent in 2022 (FY23) to 6.1 per cent in 2023 (FY24) before picking up to 6.8 per cent in 2024 (FY25), the global lender said while citing “resilient domestic demand despite external headwinds”.

The Washington-based multilateral lender raised its global growth forecast for 2023 by 20 basis points to 2.9 per cent, holding that the balance of risks remained tilted to the downside, but adverse risks had moderated since its October 2022 report.

While the IMF made a marginal upward revision to its global growth forecast for 2023, it retained its projection for India for 2022-23 and 2023-24 at 6.1 percent and 6.8 per cent, respectively, and termed India as a ‘bright spot.’

“Our growth projections actually for India are unchanged from our October Outlook. We have 6.8 percent growth for this current fiscal year, which runs until March, and then we’re expecting some slowdown to 6.1 percent in fiscal year 2023. And that is largely driven by external factors,” Pierre-Olivier Gourinchas, Chief Economist and Director, Research Department of the IMF told reporters in Washington.

“The global economy is poised to slow this year, before rebounding next year. Growth will remain weak by historical standards, as the fight against inflation and Russia’s war in Ukraine weigh on activity,” said Pierre-Olivier Gourinchas, Economic Counsellor and the Director of Research of the IMF.

Despite headwinds, the outlook is less gloomy than IMF’s October forecast, and could represent a turning point, with growth bottoming out and inflation declining.

“Economic growth proved surprisingly resilient in the third quarter of last year, with strong labor markets, robust household consumption and business investment, and better-than-expected adaptation to the energy crisis in Europe. Inflation, too, showed improvement, with overall measures now decreasing in most countries—even if core inflation, which excludes more volatile energy and food prices, has yet to peak in many countries. Elsewhere, China’s sudden re-opening paves the way for a rapid rebound in activity. And global financial conditions have improved as inflation pressures started to abate. This, and a weakening of the US dollar from its November high, provided some modest relief to emerging and developing countries,” said Gourinchas.

For advanced economies, the slowdown will be more pronounced, with a decline from 2.7 percent last year to 1.2 percent and 1.4 percent this year and next.

Nine out of 10 advanced economies will likely decelerate, said the IMF.

US growth is expected to slow to 1.4 percent in 2023 as Federal Reserve interest-rate hikes work their way through the economy. Among major economies, only the United Kingdom is projected to fall into recession (-0.6 per cent) in 2023, while growth in Germany (0.1 per cent) and Russia (0.3 per cent) may remain flat.

Euro area conditions are more challenging despite signs of resilience to the energy crisis, a mild winter, and generous fiscal support.

With the European Central Bank tightening monetary policy, and a negative terms-of-trade shock—due to the increase in the price of its imported energy—we expect growth to bottom out at 0.7 percent this year.

Emerging market and developing economies have already bottomed out as a group, with growth expected to rise modestly to 4 percent and 4.2 percent this year and next, noted the IMF.

The restrictions and COVID-19 outbreaks in China dampened activity last year. With the economy now re-opened, IMF sees its growth rebounding to 5.2 percent this year as activity and mobility recover.

“On the upside, a stronger boost from pent-up demand in numerous economies or a faster fall in inflation is plausible. On the downside, severe health outcomes in China could hold back the recovery, Russia’s war in Ukraine could escalate, and tighter global financing conditions could worsen debt distress. Financial markets could also suddenly reprice in response to adverse inflation news, while further geopolitical fragmentation could hamper economic progress,” it said.

In most economies, amid the cost-of-living crisis, the priority remains achieving sustained disinflation. With tighter monetary conditions and lower growth potentially affecting financial and debt stability, it is necessary to deploy macroprudential tools and strengthen debt restructuring frameworks, noted the IMF.

“Accelerating COVID-19 vaccinations in China would safeguard the recovery, with positive cross-border spillovers. Fiscal support should be better targeted at those most affected by elevated food and energy prices, and broad-based fiscal relief measures should be withdrawn,” it said.