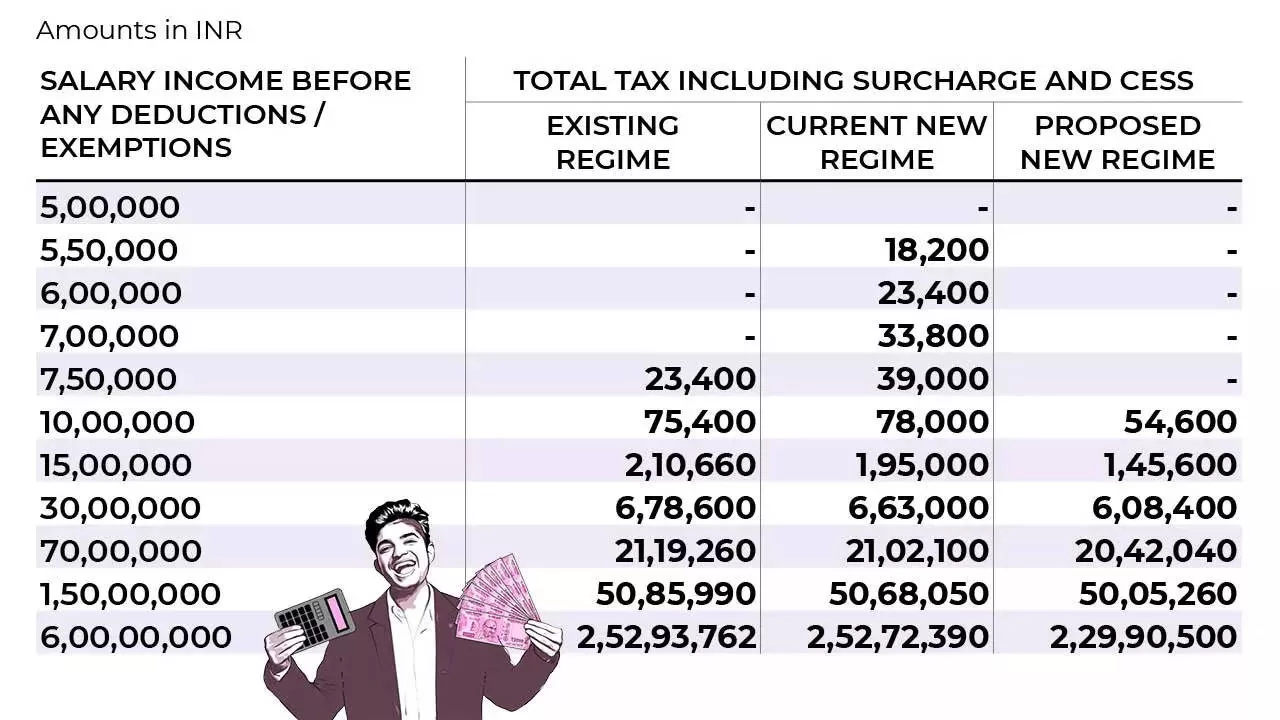

So which income tax regime should you opt for? The table below analyses the income tax outgo in the existing regular income tax regime, the current concessional income tax regime, and the new income tax regime announced by FM Sitharaman in Budget 2023:

| Salary income before any deductions / exemptions | Existing regime | Current new regime | Proposed new regime |

| 5,00,000 | – | – | – |

| 5,50,000 | – | 18,200 | – |

| 6,00,000 | – | 23,400 | – |

| 7,00,000 | – | 33,800 | – |

| 7,50,000 | 23,400 | 39,000 | – |

| 10,00,000 | 75,400 | 78,000 | 54,600 |

| 15,00,000 | 2,10,660 | 1,95,000 | 1,45,600 |

| 30,00,000 | 6,78,600 | 6,63,000 | 6,08,400 |

| 70,00,000 | 21,19,260 | 21,02,100 | 20,42,040 |

| 1,50,00,000 | 50,85,990 | 50,68,050 | 50,05,260 |

| 6,00,00,000 | 2,52,93,762 | 2,52,72,390 | 2,29,90,500 |

Assumptions: EY has considered a total of Rs 2,00,000 worth of deductions and exemptions (including standard deduction) for the purpose of above table under the existing tax regime. The above table caters to resident individual below 60 years of age. Now, standard deduction of Rs 50,000 is available by default under the proposed new regime (similar to the existing tax regime).

As is evident from the table above, if you avail tax exemptions of up to Rs 2 lakh including standard deduction, the new income tax slabs under the new income tax regime make more sense to opt for.

What are the new income tax slabs for 2023 to 2024 under new tax regime?

- Up to Rs 3 lakh income there is 0% or NIL tax

- From Rs 3 lakh to Rs 6 lakh the tax rate is 5%

- From Rs 6 lakh to Rs 9 lakh the tax rate is 10%

- From Rs 9 lakh to Rs 12 lakh the tax rate is 15%

- From Rs 12 lakh to Rs 15 lakh the tax rate is 20%

- Above Rs 15 lakh the tax rate is 30%