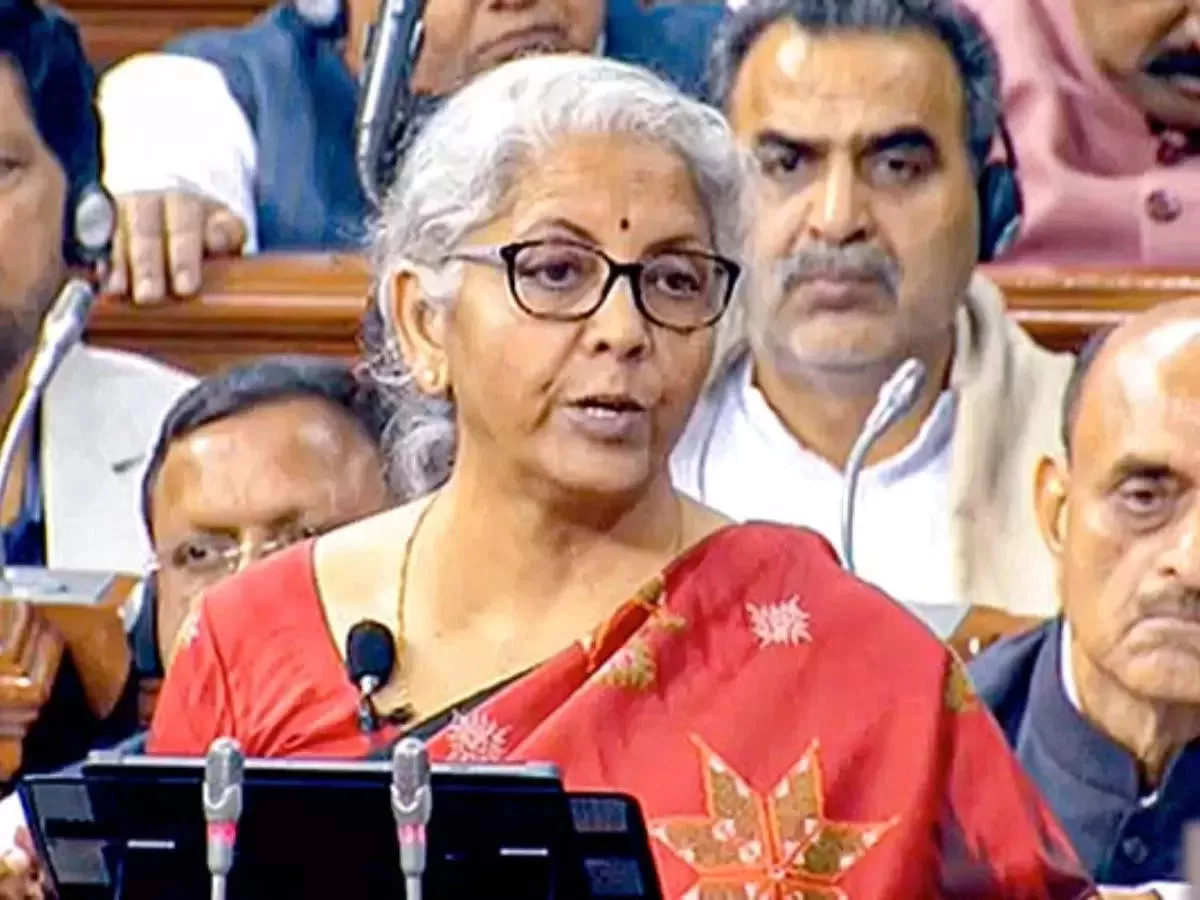

Smoking will become even more expensive as the government has increased custom duty on cigarettes to 16 percent. The announcement was made in the Union Budget presented by Finance Minister Nirmala Sitharaman on Wednesday.

Besides cigarette, jwellery made of gold and silver is also going to be expensive as basic customs duty has been hiked on articles made from gold bars.

FM proposed to increase the duties on articles made therefrom to enhance the duty differential. “I also propose to increase the import duty on silver dore, bars and articles to align them with that on gold and platinum,” she said.

However, the govt reduced basic customs duty on seeds used in manufacturing of lab-grown diamonds.

The basic customs duty rate on compounded rubber will be increased from 10% to 25% or Rs 30/kg, whichever is lower, on par with that on natural rubber other than latex, to curb circumvention of duty.

FM Sitharaman proposed a reduction in the number of customs duty rates on goods except textiles, from 21 to 13. As a result, there are minor changes in cess and levies on products such as toys, naphtha and automobiles, she said.

The government also proposed to reduce customs duty on the import of certain inputs for mobile phone manufacturing. Customs duty on parts of open cells of TV panels have also been cut to 2.5%.

Besides cigarette, jwellery made of gold and silver is also going to be expensive as basic customs duty has been hiked on articles made from gold bars.

FM proposed to increase the duties on articles made therefrom to enhance the duty differential. “I also propose to increase the import duty on silver dore, bars and articles to align them with that on gold and platinum,” she said.

However, the govt reduced basic customs duty on seeds used in manufacturing of lab-grown diamonds.

The basic customs duty rate on compounded rubber will be increased from 10% to 25% or Rs 30/kg, whichever is lower, on par with that on natural rubber other than latex, to curb circumvention of duty.

FM Sitharaman proposed a reduction in the number of customs duty rates on goods except textiles, from 21 to 13. As a result, there are minor changes in cess and levies on products such as toys, naphtha and automobiles, she said.

The government also proposed to reduce customs duty on the import of certain inputs for mobile phone manufacturing. Customs duty on parts of open cells of TV panels have also been cut to 2.5%.

Here is what gets cheaper

- Camera lenses for phones, laptops, and DSLRs

- Parts of TV panels

- Lithium ion batteries

- Denatured ethyl alcohol

- Domestic manufacture of shrimp

- Seeds used in the manufacture of diamonds

Here is what gets more expensive

- Articles made of gold and platinum

- Articles made of silver

- Copper scrap

- Compounded rubber

- Cigarettes

- Imported electric kitchen chimney

“To encourage India’s mobile handset manufacturing business, customs exemption has been extended to camera lens and other items and reduction on lithium-ion cells for another year. Customs duty on machinery required for manufacturing lithium-ion cells used in electric vehicles shall be exempted. It was also mentioned that the customs slabs shall be reduced from 21 to 13 percent,” said Saloni Roy, Partner, Deloitte India.

accorciable uomo artigianale cuoio verde scuro cintura belt for men in genuine leather, dark green, handcrafted and adjustable Seminole Belts are popular in Italy. Seminole Gemstones.